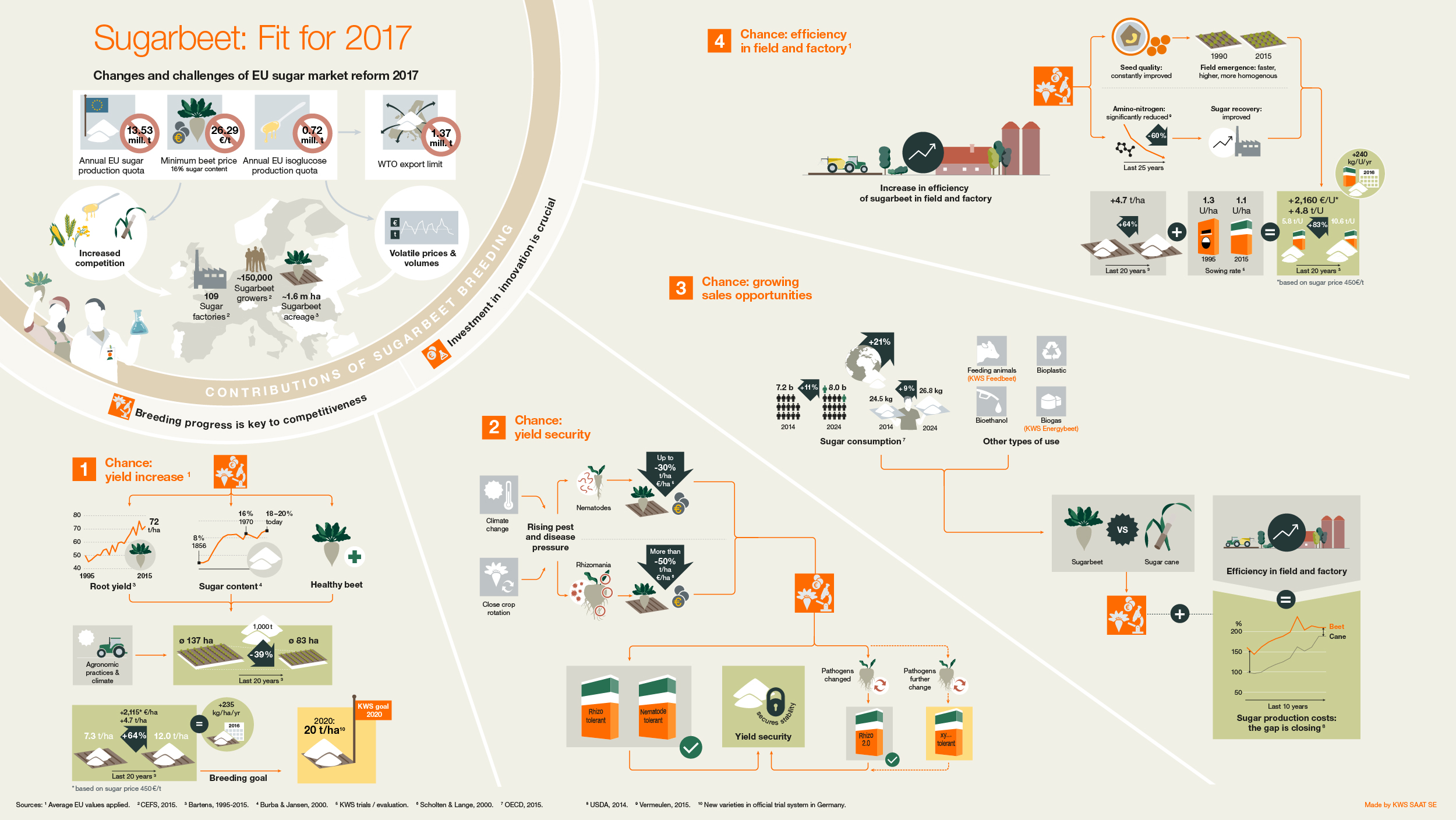

Sugarbeet: Fit in a free market

Without the contribution of research and breeding, sugarbeet cultivation would not be of large relevance in Europe anymore. The fact that the plant is still highly competitive and will be in the future is the result of the constant efforts of beet breeders like KWS. Did you know, that farmers got up to 64%/ha more sugar yield from their fields within the last 20 years? There is still more to discover as sugarbeet breeding sees different chances to the upcoming changes – Find out why growers and the sugar industry can be confident as the European sugar market reform of 2017 has been sucessfully implemented. Take your journey to the world of “Made by Breeding” and explore fascinating, informative and thrilling content.

Find out more

Far-reaching changes to the EU sugar market are on the cards since this year which have dramatically impact production, price and the prospects of sugar value chain. The reform of the sugar market regime has come into effect in October 2017 and has therefore already affected the production planning of the sugarbeet value chain. These changes brings significant challenges to the EU sugarbeet industry and its 109 sugar factories, 150,000 sugarbeet growers and 1.6m hectares of sugarbeet acreage — notably from increased competition and price volatility. Has this market reform doom and gloom for EU sugarbeet farmers?

Not at all – With change comes chances – Explore and find out!

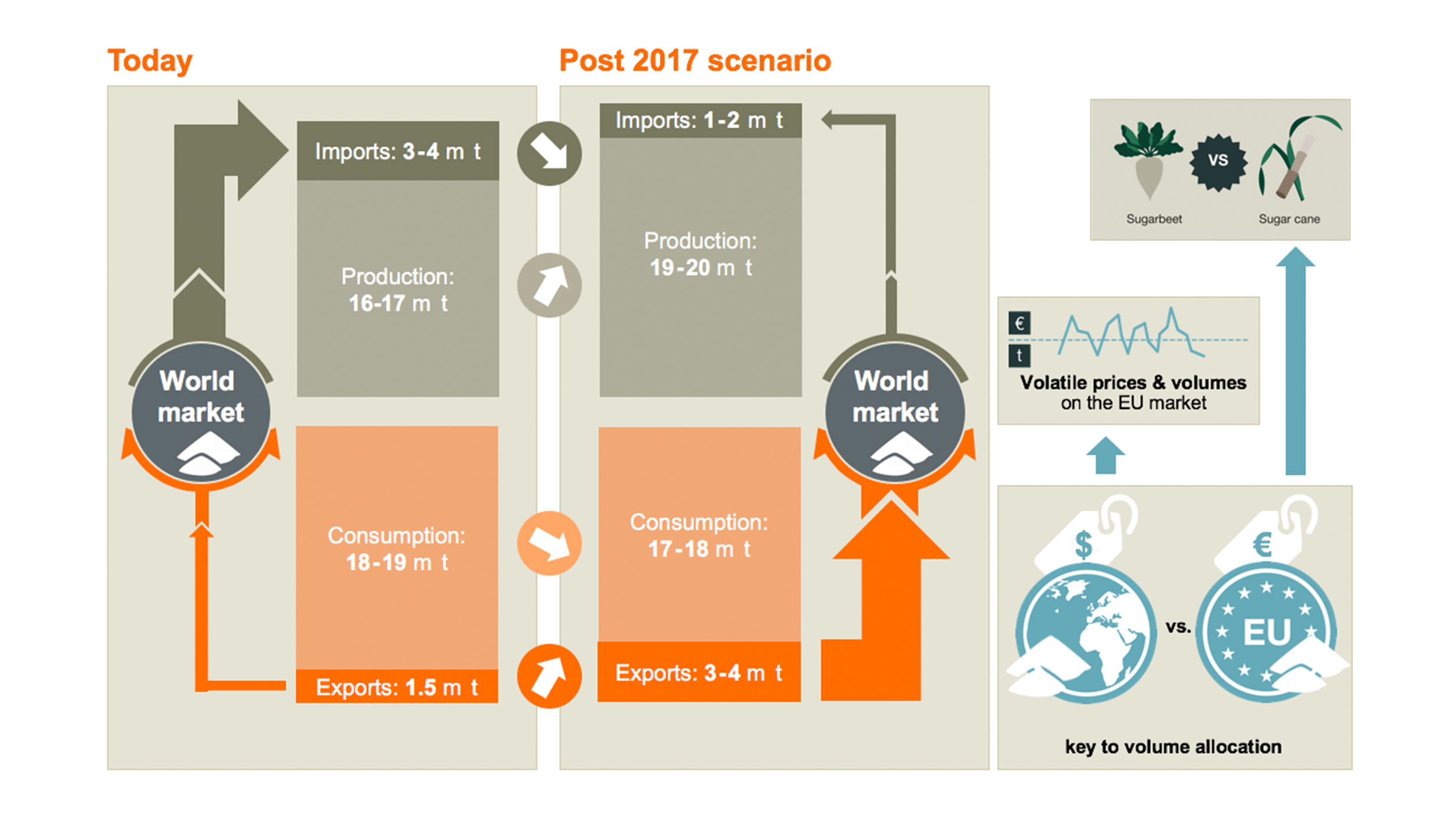

Oct 1, 2017 – a key date for the European sugar value chain. As of this date the organization of the market changes dramatically by abolishing some of its core policy measures such as production quotas for sugar and isoglucose or the minimum price for sugarbeets. What will the new, more liberal and increasingly competitive market framework do to the EU sugar balance? Today, the EU is a net importer of sugar being restricted on the export side by a WTO ruling. From 2017/18 the EU will most likely turn into a net exporter. The domestically produced sugar quantity is projected to increase in particular in markets with a highly competitive beet sugar production. This additional production will in first instance replace a large part of sugar imports and secondly result in rising export volumes. The ratio of EU and world market price for sugar will determine the attractiveness for European producers to intensify their export business. We can expect that the European sugar production and price will become more volatile as competition raises and the interaction with the sugar world market grows. Have a look at the EU sugar balance picture today and the scenario for post-2017.